- Insights

-

Aave 2030 Proposal Overview

Aave, a leading DeFi lending and borrowing platform, has unveiled its 2030 proposal, with Aave V4 as its centerpiece, scheduled for full release by mid-2025.

-

Facing Market Chaos with Determination | ZMQ 6th Anniversary

Today, ZMQ celebrates its six impactful years in the Web3 market. This journey coincides with a monumental year for Web3 as a whole.

-

Reviewing Last Week’s Market Drop

After a wild ride last week with cryptocurrency prices, things seem to have stabilized, bouncing back to a more reasonable level after Bitcoin plunged below $60000, dragging down other cryptocurrencies like ETH.

-

Factors Hindering ETH Spot ETF Approval

Following the U.S. SEC’s approval of 11 BTC Spot ETF applications in January 2024, anticipation in the market grew for the approval of the ETH Spot ETF as the next spot crypto ETF sanctioned by the SEC.

-

ZMQ at WOW Summit HK

Hong Kong’s Web3 market is not just thriving; it’s a beacon of innovation, propelled by a wider economic uplift and a bullish crypto market.

-

An insight into Re-staking

Currently, EigenLayer’s re-staking system faces challenges due to high fees on the mainnet, lack of liquidity, and limited support for Layered Staking Derivatives (LSDs).

-

Ethereum’s Dencun Upgrade

The Dencun upgrade is a game changer for ethereum Layer 2 (L2), notably reducing transaction fees and boosting throughput.

-

A broader perspective and insight of the rise of DePIN

Lately, the DePIN track has gained significant attention. On one hand, tokens like MOBILE have seen their value surge manyfold, while on the other, there’s been an influx of new forks in fields such as storage, communication, cloud computing, and energy.

-

Happy Dragon New Year!

As we celebrate the arrival of the joyous Dragon New Year, we are delighted to extend our warmest greetings to each and every one of you.

-

Annual Review of 2023: Rising Above the Tide

In the dynamic world of cryptocurrency, ZMQuant has stood out in 2023 as a beacon of innovation, stability, and growth.

-

LSDs: New Flywheel in DeFi

With two major upgrades completed by ETH, the LSD born around ETH staking has quietly flourished and gradually become an integral part of the defi ecosystem.

-

Partnership Announcement|ZMQ & Futurism Labs

We are pleased to announce that we ZMQuant have established a strategic partnership with Futurism Labs .

-

LSDFi Season — Prisma Finance

Prisma claims to be "The End Game for LSTs", allows users to mint$acUSD, a stablecoin fully collateralized by liquid staking tokens.

-

An Insight Into Decentralized Stablecoins

Most decentralized stablecoins are backed by ETH.There are also some decentralized stablecoins backed by other native crypto assets.

-

ZMQ Insight | f(x) Protocol, a new era of stablecoin

F(x) Protocol creates two new ETH derivative assets. One with stablecoin-like low volatility and the other with a leveraged long ETH perpetual token.

-

Climb on every wave of the market chaos | ZMQ 5th Anniversary

On May 18th, we finished our fifth year's journey in the field of crypto. On this occasion, we want to thank all our employees, business associates and clients who stand with us all times.

-

ZMQuant | Highlights and trends at Consensus 2023 by Coindesk

Consensus has been one of the foremost events for the global crypto, blockchain, and Web3 community since 2015, where developers, investors, founders, brands, artists, policymakers, and many other stakeholders congregate to reflect, showcase, and envision the future.

-

Review of ZMQ team trip in Hongkong Web3 Festival

The 2023 Hong Kong Web3 Festival was launched with fervor and enthusiasm in the last week, along with 150+ side events spread across the Oriental Pearl.

-

$GHO or not, a study of AAVE new stablecoin

According to Aave's roadmap, after the launch of Aave V3 on the Ethereum mainnet, the next tasks are to release the GHO stablecoin and later Portal V1.

-

The investment logic in crypto markets based on Expectations

Cryptocurrency, as a new type of risk asset, has increasingly gained more attention than traditional capital/funds. However, the pricing of risk assets is determined by the risk-free rate and risk appetite on the denominator side, as well as the performance on the numerator side.

-

ZMQ | General things you need to know about Market Maker

Market making is a financial activity where market makers, typically financial institutions or individuals, buy and sell securities in a particular market to provide liquidity and ensure that there is always a buyer or seller available for that security at any given time.

-

Direction uncertainty? Crypto Annual Review (ZMQ, 2022–2023)

The global economy is faced with numerous challenges due to macroeconomic and geopolitical factors. We saw the Fed taking action to control inflation, Europe embroiled in conflict, supply chains disrupted, the long-term effects of COVID-19 and the corresponding policies in China.

-

A brief study on the solution to the NFT liquidity, Chapter III The Light — NFT market making

Some recent studies conclude that there are some issues in the NFT market, including low liquidity, high price volatility, and long potential holding times, which bring inventory risks and high potential search costs to NFT market participants (Kim et al., 2022).

-

A brief study on the solution to the NFT liquidity,Chapter II

The previous study shows various NFT liquidity solutions with strengths and restrictions. However, the NFT liquidity issue remains and the corresponding market making is fairly risky.

-

How would the thriving DeFi economic system enlighten the NFT financialisation?

Driven by interest rate increases from the U.S. Federal Reserve aimed at controlling rampant inflation, as well as other global challenges, the crypto market has declined continuously since the beginning of 2022.

-

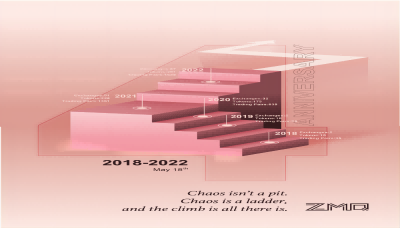

ZMQ 4th Anniversary-Yearly Review(2018–2022)

2018 is a memorable year in the crypto history. After an unprecedented boom in 2017, a lot of entrepreneurs recognized the great potential of crypto, there were a ton of new startups that were leveraging blockchain technology, and then came 80% bitcoin crashing down in 2018.